Riding the Wave: HYPE's Meteoric Rise and the Impact on Hyperliquid

Unprecedented Excitement Reaches a Peak: What's the Cause?

In the bustling world of crypto, HYPE on Hyperliquid made some serious waves in 2025, reaching a breathtaking high of $44.70. This wasn't just a blip on the radar; there was a significant surge in trading volume to back it up. And who Benefitted from the whale-sized levels of action in the derivatives markets? None other than the cunning whales themselves, raking in a hefty $13.93 million in unrealized profits!

Whales Swimming in Profit

One of HYPE's biggest investors, thanks to a daring high-leverage long position, emerged as a big fish indeed. In the last 30 days, this shrewd investor has seen a staggering return of over 121%, placing them among the top 100 traders on the platform. With a mighty net of over $10 million in realized gains, this whale's a force to be reckoned with.

The seas of HYPE's perpetual contracts have seen whales swimming in waters deep, with open positions reaching an impressive $1.89 billion. That's no drop in the ocean - it's a sign of intense interest from both institutional and retail investors pouring into this lucrative market.

Purr-fect Timing: HYPE's Rise brings Cheers for PURR

Hyperliquid's resident meme coin, PURR, couldn't resist the charms of HYPE's rally. In the last 24 hours, PURR's purring up a storm, rising by a delightful 19%, reaching the plush height of $0.29. PURR, as the resident memecoin, is thought of as a gauge token closely tied to Hyperliquid's success.

After a brief dip to the $12 levels in March-April, HYPE's been on a steady ascent. It's currently showing no significant sell-off pressure, and token unlock risks are minimal. But there are factors that might sway the tide:

- Price Discovery: It's likely that price discovery will happen on Hyperliquid- a single platform, posing some risk for investors.

- Limited Trading Pairs: Trading pairs outside of Hyperliquid are scarce, limiting opportunities for diversification.

- Derivatives' Tied Tides: A sizable portion of HYPE's liquidity remains tied to the derivatives markets, making it vulnerable to sudden shifts.

Hyperliquid: Pouring in Revenue and Users

In the last 30 days, Hyperliquid has been raking in some serious dough, generating a hefty $65.3 million in revenue. The registered user base is on the cusp of 500,000, with whales trading a whopping $300,000 daily- that's some serious liquidity.

Prominent trader James Wynn has been making some moves. He's closed his massive positions and, now, holds only a tiny BTC long position (40x leverage). Rumor has it that Wynn has shed his HYPE tokens and hedged some positions elsewhere in the market.

So, where's HYPE heading next? With high volume and low selling pressure, it looks like HYPE's testing new highs. But the fact that the price is pegged to a single platform presents a challenge for investors. The rally's longevity depends on market sentiment and the dance moves of the whales on Hyperliquid.

Bonus: Score yourself an Exclusive $600 Bonus from Binance by using this link to register.

Delving Deeper into HYPE's Journey

Crypto's current trends have been friends to HYPE, bolstered by its high-performance Layer-1 blockchain and potential listings on top exchanges like Binance and Coinbase. But a drop in market conditions, volatility, and limited listings could affect the course of this swift-moving coin.

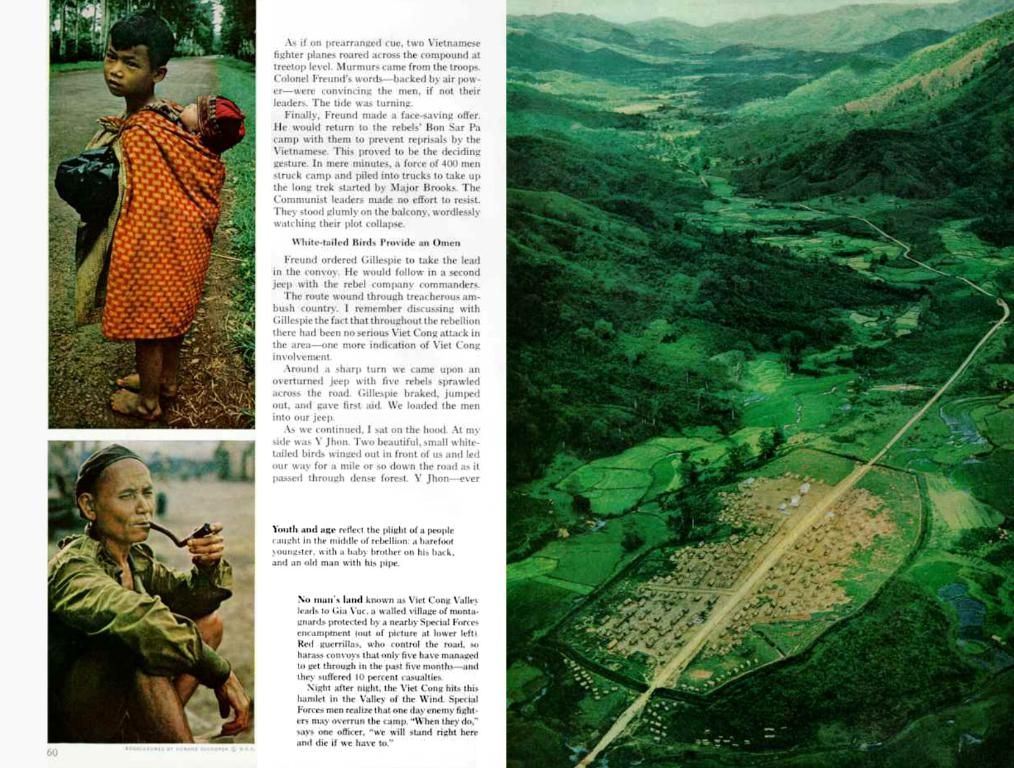

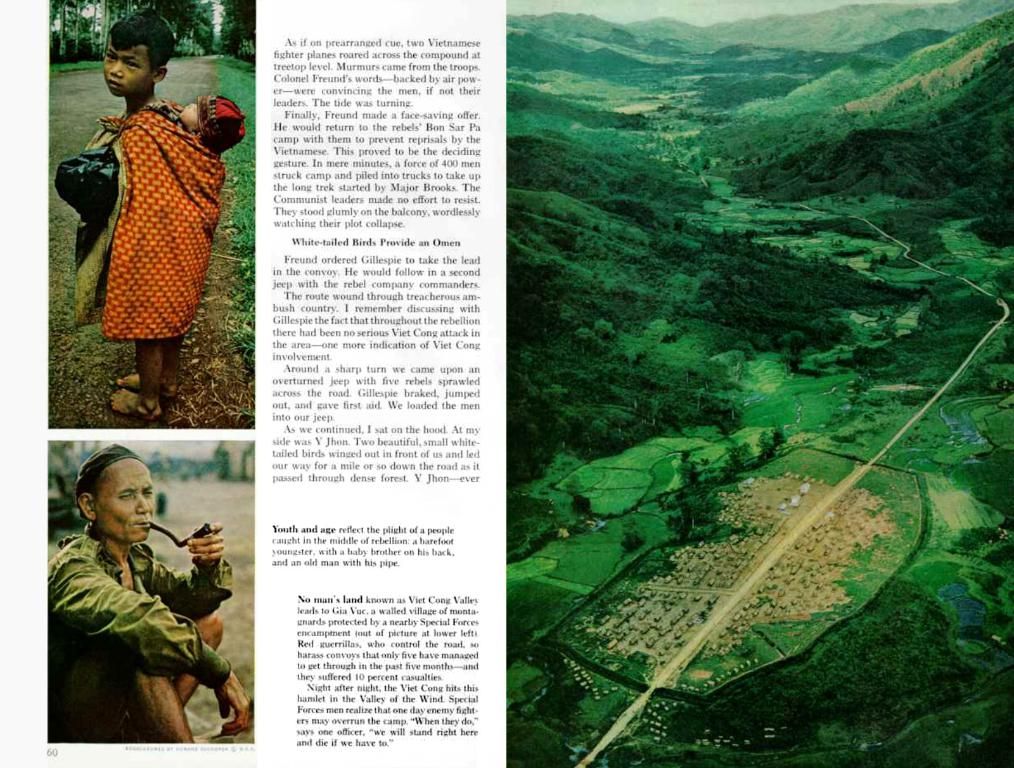

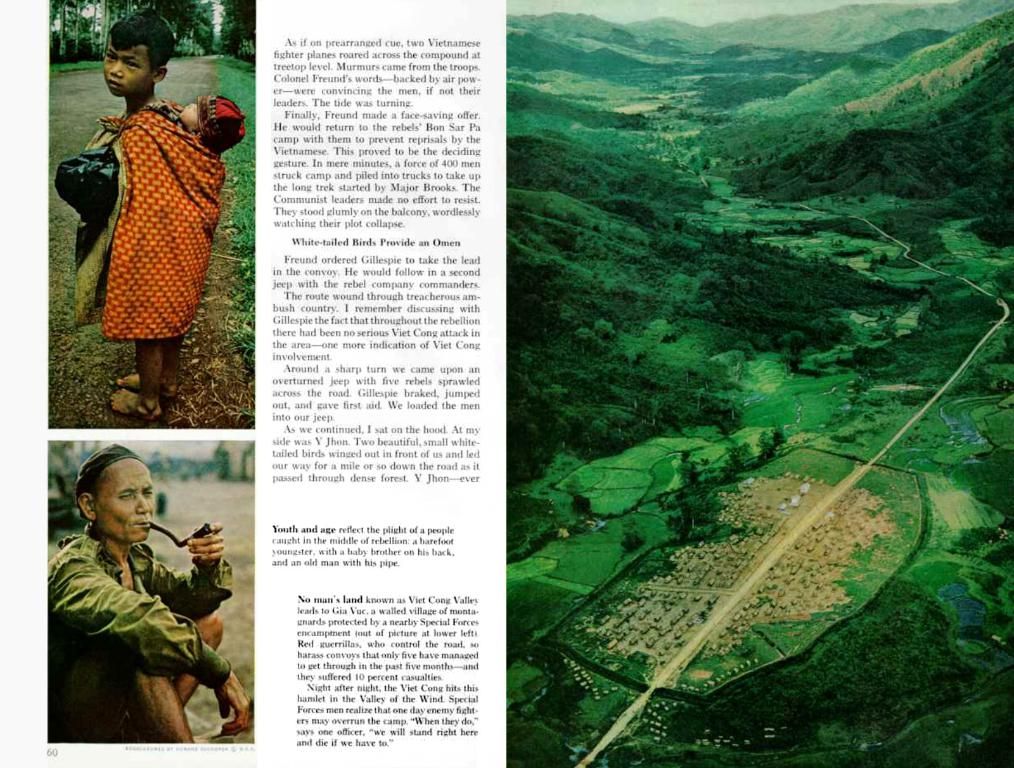

The performance of HYPE, especially in comparison to memecoin PURR, raises questions about the impact memecoins can have when a major cryptocurrency booms. While direct data on how HYPE affects PURR is scarce, broader crypto market trends can influence memecoins. A bullish market, increased liquidity, and popular crypto rallies could potentially benefit tiny fishes like PURR. But the volatile nature of memecoins means that price fluctuations often stem from community sentiment and speculative trading rather than direct correlations with specific cryptocurrencies.

- The cunning investor, who reaped over 121% return in the last 30 days due to a high-leverage long position on HYPE, has been significantly enriched by the technology-driven finance revolution, a testament to the power of blockchain-based investing.

- As HYPE perpetual contracts continue to attract immense interest from institutional and retail investors, the block chain-powered Hyperliquid platform is witnessing an influx of revenue, currently generating over $65.3 million, thus indicating a promising future for this fintech solution.