Significant Amount of Bitcoin (22,500) Moved Out of Exchanges Silently in Just One Day, Without Causing a Market Uptick in Prices

Bitcoin's Subtle Bullish Move Continues

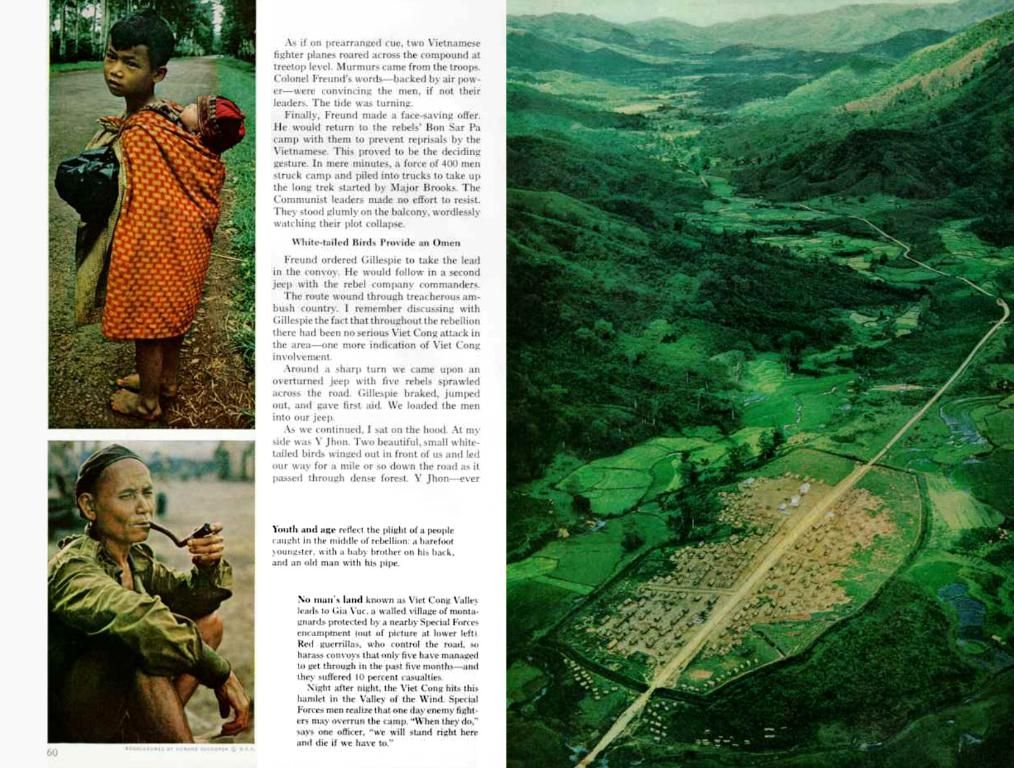

Bitcoin, in spite of its lackluster price action, is seeing a significant shift as large players gradually withdraw their coins from centralized exchanges. A single day in early June saw the withdrawal of about 22,500 BTC, hinting at institutional investors' preference for holding their stash in private wallets rather than pocketing immediate profits.

Despite this significant outflow, BTC's price dropped towards the $100,000 mark but managed to recover slightly and currently hovers around $103,500.

Signals of a Quiet Bull Run?

According to CryptoQuant's latest analysis, this pattern likely represents strategic accumulation by institutional players such as ETF providers, custodians, or OTC desks. Unlike retail investors, these whales generally keep a low profile, leading to a subdued market without any dramatic price spikes. This quiet accumulation could signify a stage of market consolidation, with strong confidence in Bitcoin's long-term value proposition.

While the immediate price action may seem stagnant, the persistent drawdown of exchange reserves may indicate that the overall supply-side pressure is easing. Historically, such supply tightening has been followed by significant upward movements, though it usually takes time.

For now, the data suggests accumulation, not distribution. CryptoQuant indicated that this isn't a lull, but a potential setup for future price increases. As selling pressure dwindles, the stage may be set for Bitcoin's next big rally.

"Don't panic. This chart tells us that faith in Bitcoin remains unshaken. The price might not explode right away, and we might be in a waiting phase, but as selling pressure wanes, opportunities become clearer."

Bitcoin's Summer Uncertainties

The continued attention on Bitcoin ETFs doesn't overlook signs that the bullish momentum may be starting to weaken and deeper structural indicators suggest a period of market consolidation, as per Matrixport's insights.

Their current models, previously favoring a bullish stance, warn of potential summer turbulence as critical US economic indicators have reached record lows since July 2024. This includes a plummeting ISM Non-Manufacturing PMI and a weaker manufacturing PMI, hinting at an overall economic slowdown that hasn't been fully priced in yet.

Additional downside risks include fallout from President Trump's tariff policies and the Federal Reserve's reluctance to reduce interest rates amidst prevailing inflation fears. The trend model for Bitcoin remains technically bullish above $96,719, but this support level is under threat.

With bond yields stagnant and the dollar showing signs of weakness, Matrixport foresees months of caution instead of conviction, with Bitcoin likely to trade sideways unless macroeconomic conditions stabilize.

The Takeaway

While institutional accumulation and bullish technical patterns hint at a potentially strong future for Bitcoin, the market is expected to be volatile in the near term, thanks to macroeconomic catalysts such as the upcoming US CPI data and the overall economic situation. If economic data triggers expectations of earlier-than-expected Fed easing, it could lead to higher Bitcoin prices, potentially as high as $120,000–$125,000 by mid to late June. But if rising inflation suggests the likelihood of no interest rate cuts, Bitcoin's price could dip to the $100,000–$104,000 range before rebounding.

- Institutions, such as ETF providers and OTC desks, are increasingly turning to DeFi platforms for crypto trading, seeking opportunities beyond centralized exchanges and wallets as a means to accumulate Bitcoin.

- As Bitcoin's price fluctuates, the value of crypto investments is analyzed through emerging technology, revealing a potential bull run looming, notwithstanding the market's current quietness.

- While the summer may bring uncertainties to the Bitcoin market due to macroeconomic factors, a significant rally could still materialize if the Federal Reserve eases interest rates in response to economic data, driving crypto prices as high as $120,000–$125,000.