A Precautious Look Ahead for BLG Port Logistics in 2024

Cautious Encouragement at BLG Port Logistics Operations - Cautious optimism prevails at container logistics firm BLG amidst signs of improved business activity

Hey there! Hearken to the vibe at BLG Port Logistics, based in Bremen, which is swimming in cautious optimism for this upcoming year. Matthias Magnor, the big cheese, commented that it's supremely important to keep a sharp eye out for opportunities and stay vigilant. Shifts in the energy and automotive sectors, newly formed shipping consortiums, and international collaborations may usher in new horizons.

The container division is the group's primary focus. One of their subsidiaries, Eurogate, pumped up the throughput by 10.2% last year. They anticipate heightened throughput in Bremerhaven and significant growth in Wilhelmshaven with Hapag-Lloyd hopping aboard as a fresh shareholder. They predict a stable volume for the Hamburg locale.

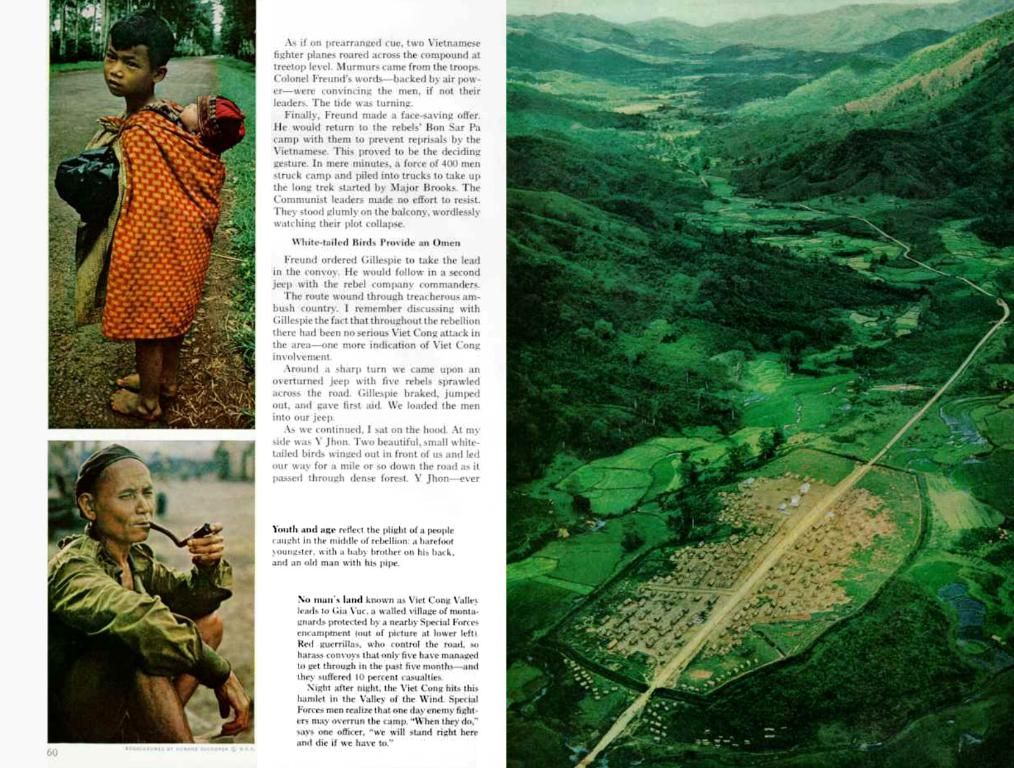

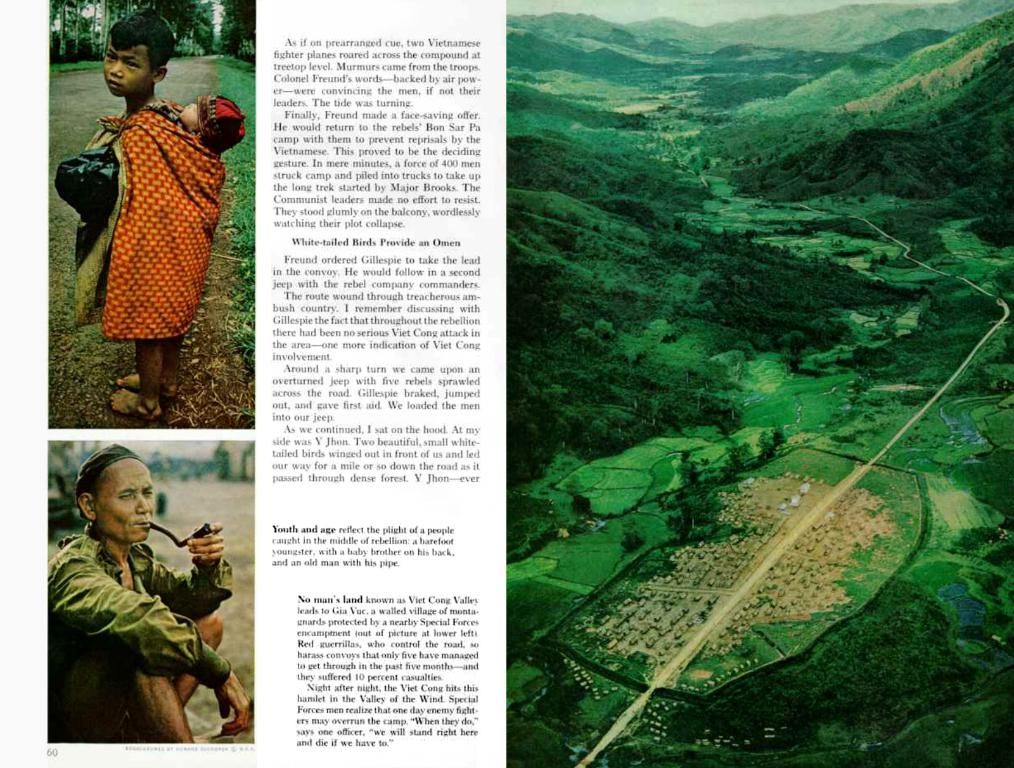

Vehicle traffic plummets by 15%

The handling and transport of automobiles fell short of expectations. In 2023, BLG dealt with 1.3 million vehicles at the Bremerhaven terminal, roughly 15% less compared to the previous year. BLG is now setting its sights on technical services and higher margins in transport to help improve performance in the automotive sector for 2024.

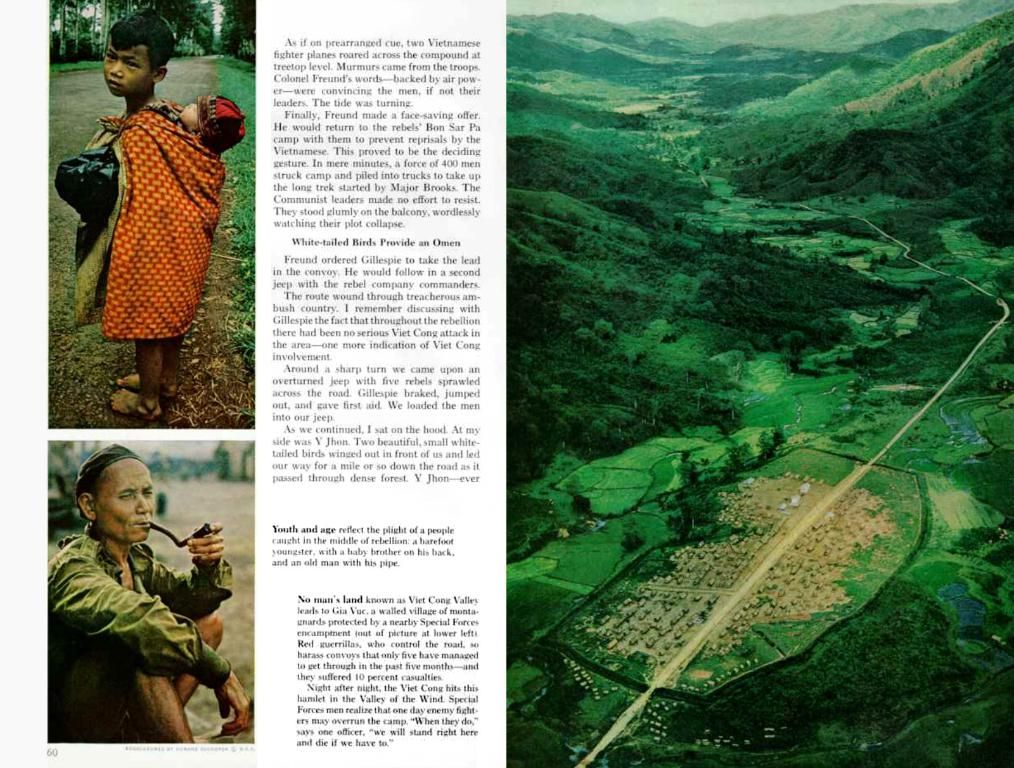

Despite the hardships in the automotive industry and geopolitical uncertainties, revenue remained on an even keel. The company's earnings totaled approximately 1.2 billion euros last year, as per their announcement.

Here's a lowdown on the opportunities lying ahead in the automotive and container segments:

Automotive Segment in Bremerhaven

- Game-changing Agreements: BLG Logistics quills a strategic agreement with Cosco Shipping for car imports from China, placing Bremerhaven in the limelight as a major hub. This points to an increased likelihood of automotive logistics traffic and associated revenue swelling[5].

- Effect of U.S. Tariffs: U.S. tariffs are projected to reduce traffic (some 15% less) thanks to protective trade barriers. However, BLG is pushing back by diversifying its operations and gearing up for these changes[3].

- Boooming Market: The global automotive logistics market is alive and kickin', with a projected CAGR of 18.9% until 2034, which could provide a positive push for BLG's operations[4].

Container Segment at Wilhelmshaven

- Turbulence in the Market: The container shipping market wrestles with challenges such as overcapacity and disruptions. But carriers' emphasis on digitalization and varied services could offer prospects for ports like Wilhelmshaven to elevate their offerings[2].

- Agility amid Instability: The market's tenuous stability necessitates dexterity for ports to dance around alterations, like alliance reshuffling and geopolitical crackdowns. In a pirouette, BLG could flex its adaptability to keep its container segment competitive[2].

All in all, although hurdles like trade restrictions and geopolitical tensions present themselves, BLG Port Logistics is gearing up for growth following strategic partnerships and flexibility across both the automotive and container segments.

- The community policy at BLG Port Logistics in 2024 emphasizes the importance of remaining vigilant to seize opportunities in the automotive and container segments, such as the strategic agreement with Cosco Shipping for car imports from China, which could increase automotive logistics traffic and associated revenue.

- Matthias Magnor, the CEO of BLG Port Logistics, recognizes the critical role of vocational training in maintaining the company's competitiveness, particularly in light of the market turbulence in the container shipping industry, where carriers are focusing on digitalization and varied services.

- Despite the predicted reduction in automobile traffic (15% less due to U.S. tariffs), BLG Port Logistics is leaning into technology and business innovations to offset these challenges and sustain its financial growth, with revenue totaling approximately 1.2 billion euros in 2023.

- To bolster its growth in 2024, BLG Port Logistics is investing in vocational training programs to improve transport performance in the automotive sector and technical services. This emphasis on human resources development aligns with the company's commitment to logistics excellence and staying at the forefront of the industry.